Having such a document helps ensure that if something happened to you, either death or disability, your loved ones wouldn’t have to do any sleuthing to find your assets and be aware of any debts you owe. Why you need to do it: A master directory, while not part of the official estate-planning lexicon, is simply a document enumerating your financial assets and liabilities.

#Basic estate planning checklist series

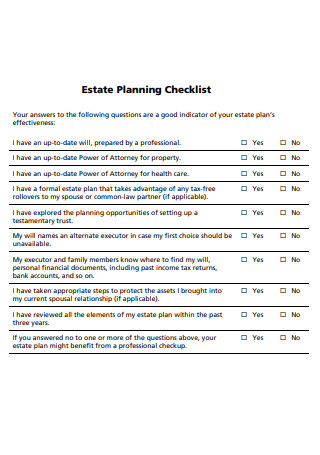

Crafting an estate plan involves a series of steps, some of which you’ve probably already undertaken and are probably going to need to revisit as your life unfolds.Īs you do tackle your estate plan, here are the key jobs to check off your list:Ħ) Draft powers of attorney for healthcare and financial matters.Ĩ) Create a trust (if needed).

It’s helpful to think of estate planning as a process, rather than something that’s one and done and begins and ends in an attorney’s office. Ditto if you’ve picked a guardian for your young children-even if you’ve not yet formalized it-or compiled a list of all of your household’s liabilities and assets. If you’ve designated beneficiaries for your retirement accounts, you’ve started the estate-planning process. The good news is that you’ve probably already done a little bit of estate planning you just may not be aware of it. Is it any wonder that so many people put off estate planning, and less than half of the U.S. So, that’s a potentially costly exercise that involves contemplating your demise and may be mainly for rich people anyway.

0 kommentar(er)

0 kommentar(er)